M1 Finance: One Year Later

Table of Contents

It’s been more than a year since I last posted about M1 Finance. Just wanted to give an update on my investing journey on what I’ve learned and adapted along the way.

Investing Strategy Changes #

The 2020 year has been a pandemic year where we had a bit of a recession in March/April. Dividends of companies got suspended as well as lost value in favor of many growth and stay-at-home stocks.

In response, I droppped my dividend focused portfolio in favor of just keeping an ETFs only portfolio. I didn’t want to have 50+ stocks in an account where I was just incrementally purchased fractional shares every week. I want my numbers to go up, but I’d rather keep it more simple with fewer holdings that I have more conviction in.

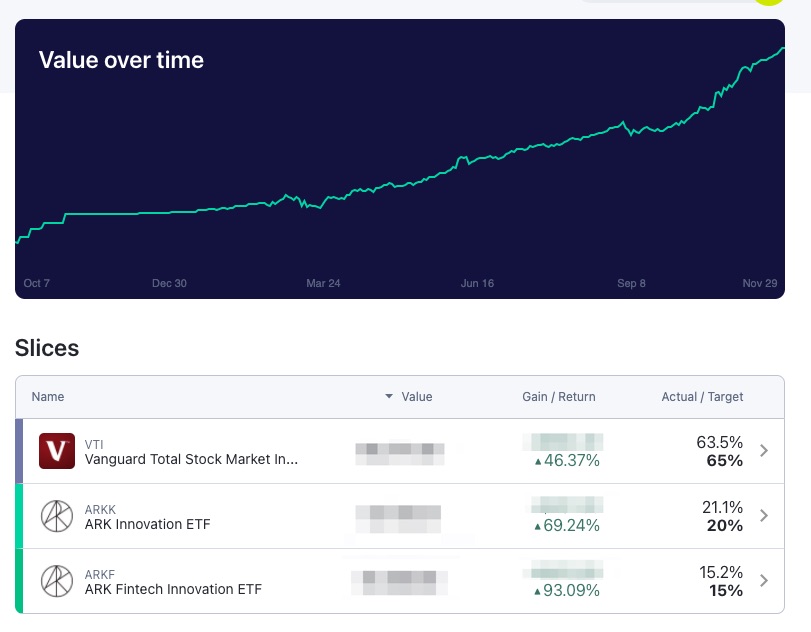

I changed my Core 4 ETFs in favor of some more growth. My changes:

- Sold out of International (VXUS), Bonds (BND), and REITS(VNQ) ETFs completely

- Added Ark Invest’s ARKK and ARKF

- Increased VTI from 48% to 65%

| ETF | Symbol | Percentage |

|---|---|---|

| Vanguard Total Stock Market | VTI | 65% |

| Ark Innovation ETF | ARKK | 20% |

| Ark Fintech Innovation ETF | ARKF | 15% |

My performance of value over time has been very satifactory. I pretty much kept to a weekly deposit schedule (Wednesdays), with occasional boost in an amount when the market dipped significantly.

Ark Invest #

I love the work of Ark Invest. Besides an a simple and cheap S&P500 index fund ETF, I recommend the ARK Innovation ETF (ARKK). It’s their premiere ETF they offer that contains the best of the best innovative companies.

Ark Invest’s CEO/CIO, Cathie Wood and her analysts do an amazing job finding innovating companies for their portfolios.

They have an expense ratio of 0.75% on all their ETFs. Not expensive, but also not cheap either! But I think it’s worth it for them to do the work/research that I cannot do. The results speaks for itself.

Besides ARKK, I like ARKF and ARKG. I’m very bullish on Fintech and Genomic technology.

M1 Finance as a Brokerage #

M1 succeeds at making some difficult things easy, but struggles with the easy things. Fractional shares, auto-invest, dollar cost averaging, and portfolio allocation (pies) are all amazing and well done. But their customer support is a weak point as a brokerage. This seems to be a problem at a lot of the smaller start-up brokerages like Robinhood. They are great at getting young people to be clients on a great easy to use mobile platform, but they don’t have customer service! You will not find customer service a problem at more traditional brokerages like Fidelity or Charles Schwab.

When I was trying to close one of my accounts with M1, I contacted support via email and wasn’t able to get the request completed for over a month. I know they use Zen Desk for their customer support. I had to follow up several times before someone took action!

Final Thoughts #

I will continue to use M1 Finance as a brokerage. As I am bullish on my investments, I also believe M1 Finance will continue to grow in the coming years.

Links #

- M1 Finance referral - Sign up for M1 Finance with this link (via desktop browser).

- ETFs pie - My main M1 Finance portfolio based on ETFs.