Lately I’ve been spending a lot of time reading books and watching youTube videos on investing. For years I’ve heard a lot about the Robinhood and Acorns apps, but there was nothing about them that made me want to try them out, or move away from my traditional brokerages. It’s great that they have mobile apps and free trades for young investors and beginners, but I’d rather manage my investments carefully on a desktop browser.

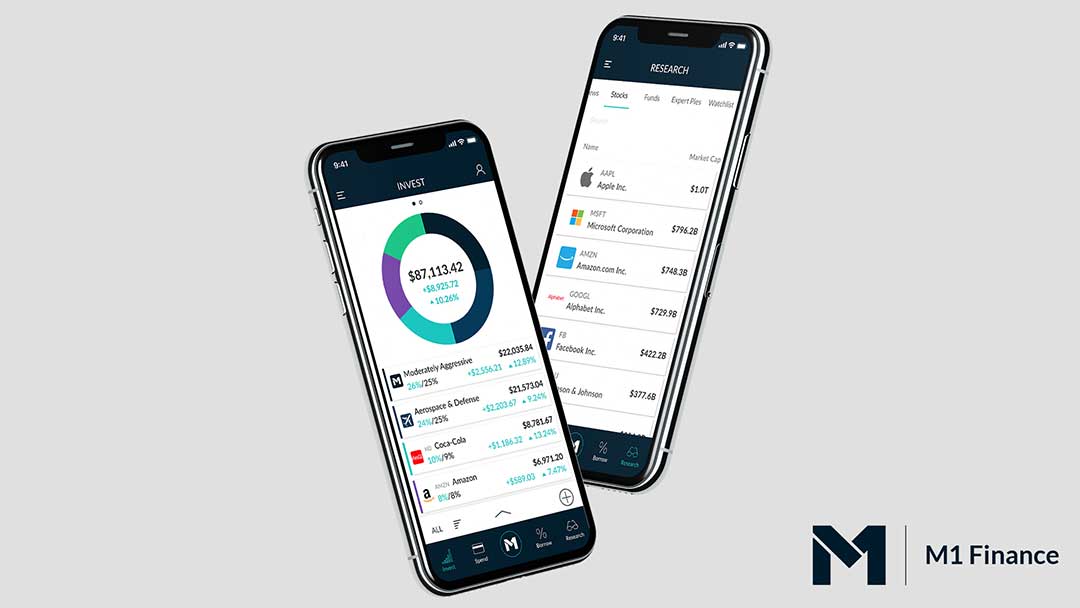

Soon enough I came across videos and blog posts recommending M1 Finance. What stood out was that it allowed for custom pies, free trades, partial shares, and autoinvesting. These are features

This blog post is about M1 Finance Invest. There are other services from M1 such as Borrow and Spend. But I have no plans or interest to use them.

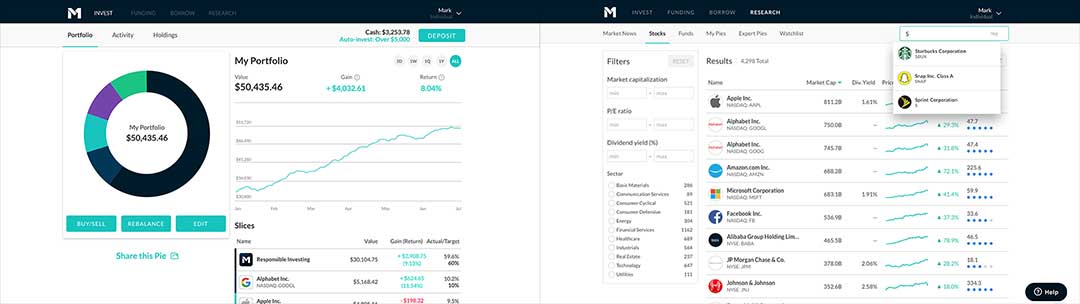

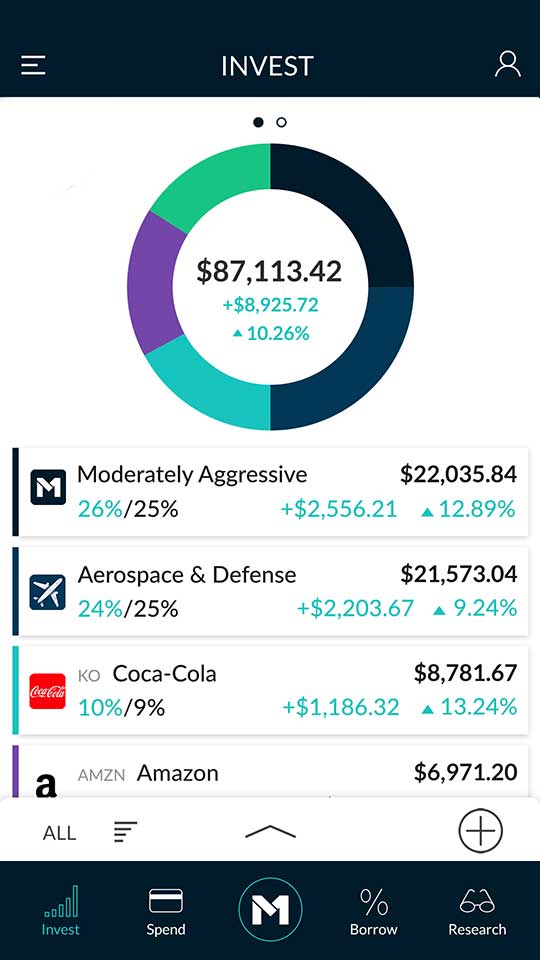

I really like looking at my portfolio as a pie. I think it’s important to have a portfolio that is diversified across sectors to spread risk as well as reap rewards. Too many brokerages default to a table view and leaves you hanging on how to balance your portfolio.

Another really nice touch is having the company’s icon with each stock/ETF. Design-wise, it’s easier to identify companies by their logo than reading text.

When building and researching your portfolio, you can add stocks/ETFs directly into it. Or you can create a custom pie to add them into, then add pies to your portfolio. I think most people, including myself, organize these custom pies by sectors.

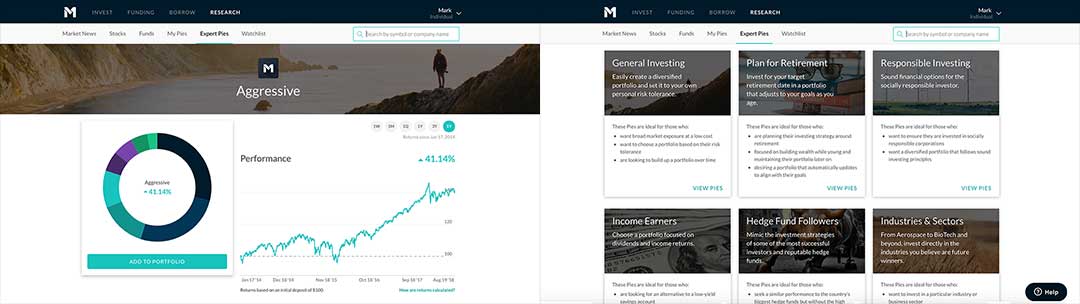

There is simplicity with the “Expert Pies” section, where you can pick from allocated pies based on what your goals and strategies are. They’re nice, but I like things to be even more simple when constructing a portfolio, so I prefer to look at Boglehead’s Lazy Portfolios.

Here’s my breakdown of the Pros/Cons of using M1 Finance:

Pros

- You can buy partial/fractional shares.

- You can create individual, joint, and retirement accounts.

- Autoinvest feature (Great for DRIP– dividend reinvestment plan)

- Schedule deposits into account(s).

- Every penny can be put to work.

- Create custom pies.

- Pies that auto balance as you keep funding it.

- Create your own custom ETF!

Cons

- Not for day traders

- Not for buying individual stocks/ETFs

- No Mutual funds.

- Only one trading window per day, in the morning before lunch.

- You buy market price of selected stock/ETFs.

Say you want to own a piece of Amazon. Their stock is currently trading in the $1700-1800 range. For most people, that’s a lot of money for a single share. With partial shares you can own Amazon stock, but just a fraction of it.

A lot of people think they can time the market, they they can buy at low and sell at high. Time in the market is better than trying to time the market. It’s a better overall strategy to regularly fund your portfolio now, than to wait hoping that you will hop in at the right time with the right investments. No one really knows the future.

New vs Old Brokerages

M1 Finance, Robinhood, Acorns, and WeBull represent the new brokerages, aimed at millennials and young people. They seem to be mobile first with beautiful and simple design on all screen sizes. I really like the disruption they bring, as a lot of brokerages have dropped their commission fees. To be fair though, it is only a matter of time before they all drop their fees to $0 since for years the price has been dropping.

If you prefer to buy individual stocks in full, then Robinhood is probably more for you.

I just don’t like Acorns investing strategy. It seems too basic for people who want to get started in investing, but only want to do so with their spare change by rounding up purchases. To me that’s not a strategy. Maybe some months it’s a lot of coins, other months maybe very little to none. And on top of that they have a $1 per month fee for accounts under $1 million, which would be most users. So say your rounds ups amounts to $10 per month. The Acorn fee would be 10%. That’s terrible!

I haven’t really looked into WeBull yet, nor have I seen many others jump to use them yet.

I am often frustrated with the “old” or more traditional brokerages like Vanguard and Fidelity. Navigating and using their website on the desktop browser is just awful. I have to click too many links too many times just to see the data I want. Their mobile apps are also poorly designed. Maybe the one clear advantage they have is they may have a physical location you can visit in person near you. And probably better customer support.

My Portfolios

Here are two portfolios I have set up with M1 Finance:

Core 4 ETFs

This portfolio is based off of Rick Ferri’s core four fund “cornerstone” portfolio (80/20). The Aggressive Growth portfolio has an allocation of 80% in equity and 20% in fixed income.

| ETF | Symbol | Percentage |

|---|---|---|

| Vanguard Total Stock Market | VTI | 48% |

| Vanguard Total International Stock | VXUS | 24% |

| Vanguard Total Bond Market | BND | 20% |

| Vanguard REIT | VNQ | 8% |

See Classic Core-4 Portfolio Allocations.

The strategy isn’t to find the needle in the haystack, just buy the haystack. As the total market grows, so does this portfolio. This is a long term strategy, so just buy and hold until I retire. I have no plans to change allocation until I’m in my 50s or 60s.

Passive Income

This portfolio is based off of Joseph Carlson’s passive income pie, which is a dividend focused strategy in building wealth. It resembles a snowball effect where the monthly or quarterly dividends gets reinvested into the portfolio so you own more and more shares that pays dividends. The snowball gets bigger and bigger. Later on in life, after the portfolio grows to a large snowball, you may opt to have the dividends to pay your monthly bills or send you checks rather than be reinvested.

It’s important to pick good dividend paying companies too. This kind of portfolio is mostly blue chip stocks that have a history of paying out dividends as well as increasing it. I avoid any high yield dividends that seem seem unsustainable. Many of these companies have gone through multiple recessions too, so there’s some comfort knowing that they are well managed.

This is also a portfolio that I will make small tweaks to over time. For example, I may increase or decrease the Consumer Defense sector by a few percentage points to make room for changes in another sector. No rebalance needed, as future deposits will fund sectors where need be.

Disclaimer, these portfolios are what I think fits my needs. Your goals and situation(s) will be different from mine, so be sure to do your own research when you invest your money!

Final Thoughts

M1 Finance is a great brokerage for those looking to do long term investing. You just need to design the portfolio pie allocations you want, then set a schedule or fund the portfolio when you can from your bank account. And that’s it. Set it and don’t fret about rebalancing unless you sell shares, which shouldn’t happen often at all.

For long term investors, the buy and hold for years type, the market price you pay is just fine. It’s not about trying to buy at the low for the day, month, or year. The strategy is to keep funding the account and getting those averages in basically. Twenty or thirty years from now, it won’t really matter if you bought at the absolute lowest. What’s important is that your money i

If traditional brokerages start offering partial shares and better UI in desktop/moble, then M1 would maybe be in trouble. But I don’t see that happening any time soon. I can see M1 improving their checkings account and eventually offering a credit card. Maybe even do what Acorns has with an option to round up charges to nearest full dollar so you can have another small stream of cash for investing!

For now, I’m really happy using M1 Finance. But I also wouldn’t be surpised if they get bought out in the coming year.

Resources

Here are some resources for your reading and research.

Books on Investing

- The Intelligent Investor by Benjamin Graham

- The Little Book on Common Sense Investing: The Only way to Guarantee Your Fair Share of Stock Market Returns by John C. Bogle

- Becoming an Investor: Building Wealth by Investing in Stocks, Bonds, and Mutual Funds by Peter I. Hupalo

Essential Websites

- The Motley Fool - Daily financial analysis reading.

- Seeking Alpha - Financial analysis, news, custom portfolio watchlists, and stock symbol look ups.

- Stocktwits - Custom watchlists and read the market chatter– often a lot of noise.

- Yahoo Finance - Import your portfolio(s) and get real time updates.

More Websites

- Ark Invest - Let’s talk about the future.

- Bogleheads.org - Investing Advice Inspired by Jack Bogle. Also see Lazy Portfolios.

- ETF Research Center - Compare 2 ETFs to see what overlaps.

- HyperCharts.co - Galileo Russell’s (Hyperchange) project/service focused on disruptive companies.

Referral and Promotion

If you liked my blog post and want to open and M1 Finance account, please use the referral code below as there is an ongoing promotion. The current promotion is give $10, get $10. When you sign up and fund your account, we both get $10!

Referral: https://m1.finance/WVxtGBcwdF5g

Be sure to sign up on the website through the link above.